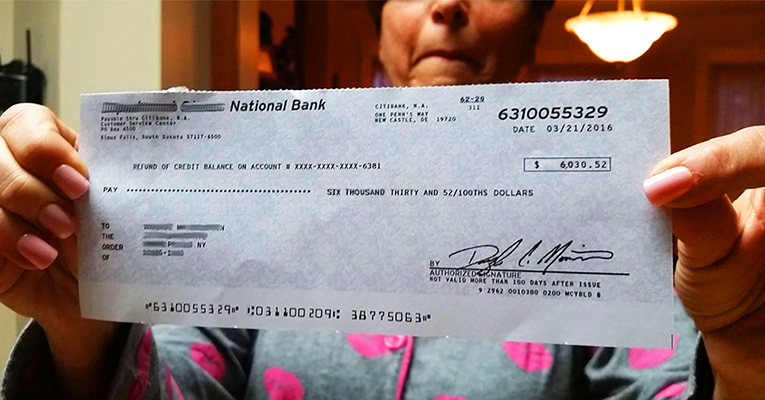

Forgotten Homeowner Savings Program Is Giving Up To $3,627 Back To Homeowners This Week

Last Updated: Debra Sullivan | April 15th, 2021

Under the current administration, the economy is greatly reaping the benefits from middle-class homeowners. If you see value in doing improvements, remodels, planning ahead for early retirement or paying off bills and debt, you should take advantage of this government backed program as soon as possible.

Banks do not want homeowners to know about these programs as they can greatly lower mortgage payments for middle-class homeowners, improve their home or take care of other expenses as well. Luckily these programs have been extended throughout 2021 with no deadline announced so we recommend checking your eligibility as soon as possible!

Homeowners may qualify for their $3,627 savings if they meet the following:

- Own A Single Family Home

- Have No Recent Missed Payments

- Owe $100,000 or more on their mortgage

- Indicate having "Good" or better credit when checking availabiity

As there is no deadline currently in place, homeowners are urged to take advantage of this program before deadlines are announced.

Every homeowner should complete the mortgage relief survey here to check if they're owed this $3,627 savings.

Here's Who It's For:

Savings from these programs for homeowners can help go towards various expenses such as home improvements, remodels, debt or other bills aimed to help middle-class Americans and stimulate the economy. The majority of people benefiting from these programs are using the funds towards home improvements/remodels.

How Do I Know If I Qualify?

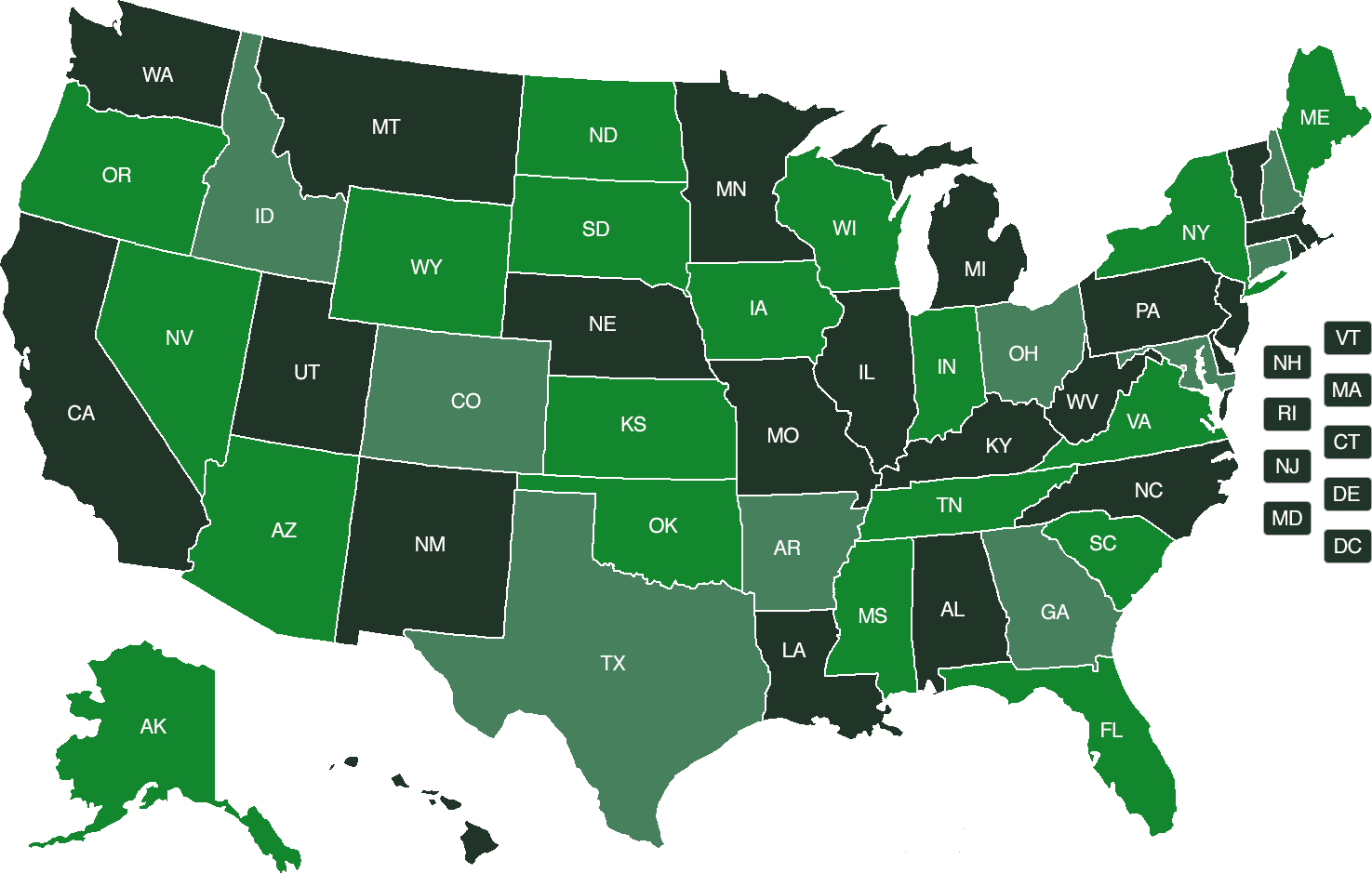

For homeowners in it's completely free to see if you qualify and takes 60 seconds or less. If you have a mortgage balance of under $719,000 you are more likely to qualify for a much larger cash out payment.

Pro Tip 1: A credit score of 600+, which is considered "Good" credit, can help you get the largest possible payout.

Step 2: Only single-family homes are eligible. No apartments or mobile homes (Sorry!)